India’s Top Smartphone Companies by Market Share and Earnings

India’s smartphone market in 2025 is more complex than it looks on the surface. The brands selling the most phones aren’t always the ones making the most money. While volume leaders dominate shelves and advertisements, the real competition is unfolding in revenue figures, premium pricing, and long-term positioning.

With rising average selling prices and stronger local manufacturing, this post breaks down which companies are truly leading by shipments, by earnings, and by strategy.

If you’re trying to understand which smartphone brands are truly dominating, by sales and by revenue, here’s the full picture based on Q1 2025 results.

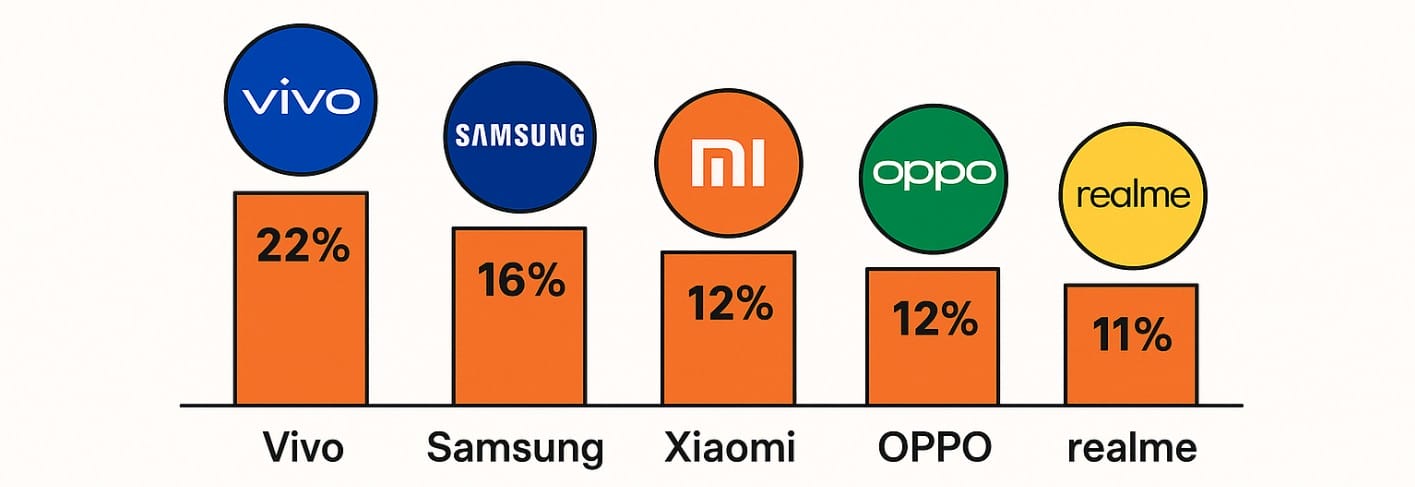

1.Smartphone Market Leaders by Shipments: Who Sells the Most Phone Units in India?

During Q1 2025, India’s smartphone shipments fell to 32.4 million units, down by about 7% year-on-year. The overall market declined, but some brands gained ground even in this environment.

Phone Brand Shipment Rankings (Q1 2025):

| Brand | Market Share | Units Shipped | Year-on-Year Growth |

|---|---|---|---|

| Vivo | 22% | 7.0 million | +13% |

| Samsung | 16% | 5.1 million | -23% |

| Xiaomi | 12% | 4.0 million | -38% |

| OPPO | 12% | 3.9 million | +5% |

| realme | 11% | 3.5 million | +3% |

While Vivo led in overall shipments, Samsung retained a strong presence. Xiaomi experienced the sharpest drop, losing ground in both volume and public visibility.

2. Why Apple Isn’t in the Top 5 for Shipments

You might be wondering why Apple isn’t listed among the top brands by units sold.

That’s because Apple sells fewer iPhones compared to brands like Vivo or Samsung, around 2.8 to 3.1 million units in Q1 2025, according to Canalys and Counterpoint Research. This places it just outside the top 5, usually at rank 6 or 7.

But what Apple lacks in shipment volume, it makes up for in revenue. With iPhones priced significantly higher than average smartphones in India, Apple captured the highest revenue share, around 26% of the entire market’s value in Q1 2025.

So even though fewer people buy iPhones, those purchases bring in more money per device than any other brand.

3. High Revenue Performance: Which Phone Brands Earn the Most?

Shipment numbers tell one story. But the real market power lies in revenue share, the total money made from device sales. This reflects consumer spending patterns and brand strength at the higher end.

Revenue Rankings (Q1 2025):

| Brand | Share of Revenue | Year-on-Year Growth |

|---|---|---|

| Apple | ~26% | +29% |

| Samsung | ~23% | Stable |

| Vivo | ~15% | Increasing |

Apple now leads the Indian smartphone market in revenue, despite not appearing in the top five by shipment volume. Its strategy of expanding local assembly and growing the premium iPhone lineup has worked, especially in metro cities and among working professionals.

4. What’s Helping These Smartphone Brands Stay Ahead

Each phone brand is using different strategies to stay relevant in India. Some focus on affordability and scale, while others lead in design, features, or aspirational value.

Vivo: Gaining Ground Through Distribution

Vivo has built its growth around Tier 2 and Tier 3 cities. It pushes a strong offline presence and offers consistent options in the ₹12,000-₹20,000 segment. Models like the Vivo T2x and Y-series have remained popular due to design upgrades, battery life, and accessible pricing.

Samsung: Balanced Lineup With Local Production

Samsung continues to benefit from its local manufacturing plants in Noida and Tamil Nadu. This improves supply chain control and pricing. Its Galaxy M and A-series handle the mid-range, while the S-series keeps the premium segment stable. Software reliability and a wide retail network contribute to Samsung’s consistent brand appeal.

Xiaomi: Facing Headwinds After Early Dominance

Xiaomi once led India’s phone shipments but has seen a 38% decline in Q1 2025. Its online-first strategy and value-for-money branding have hit limits. While still strong in the ₹8,000-₹15,000 price range, Xiaomi has struggled to convert users looking for long-term device support or better cameras.

OPPO and realme: Reliable Options in Mid-Tier Space

These two brands are part of the BBK Electronics group but have separate identities. OPPO leans on its offline retail network, while realme is more visible online. Both focus on battery life, design, and fast charging. These features attract users who want good specifications without entering premium pricing.

Apple: Focused on Premium Experience and Local Assembly

Apple’s rapid revenue growth in India is not just due to the iPhone 15 or SE. The company now manufactures over 15% of iPhones sold in India locally. With EMI offers, buyback programs, and strong marketing in major cities, Apple has grown its presence across younger professionals and business buyers.

5. Shifting Mobile Phone Market Trends You Should Know

Higher Spending per Phone

Average selling price (ASP) of smartphones in India is now at its highest-ever level. Phones priced above ₹45,000 have seen double-digit growth, even while overall sales have slowed. This shows a move away from quick upgrades toward quality and longevity.

Stronger Role of Local Manufacturing

More than 70% of all smartphones sold in India are now made locally. Companies like Samsung, Apple, and Vivo continue expanding Indian operations, which helps keep costs stable and supports job creation.

Changes in Buying Behavior

Offline stores remain important in smaller towns. Meanwhile, flash sales and e-commerce continue to drive purchases among urban users. Discounts and seasonal offers influence buying decisions more than brand loyalty in many segments.

6. Top 6 Mobile Phone Companies by Share and Earnings in India

| Metric | Brand Leading | Details |

|---|---|---|

| Shipments | Vivo | 7 million units in Q1 2025 |

| Revenue | Apple | ₹21,000+ crore in Q1 2025 |

| Fastest Revenue Growth | Apple | +29% YoY |

| Largest Decline in Units | Xiaomi | -38% YoY |

| Offline Sales Strength | Vivo, OPPO | Strong in Tier 2/3 cities |

| Online Popularity | realme, Xiaomi | Dominant during sales periods |

Summary – Real Market Leaders by Volume and Earnings

By mid-2025, India’s smartphone market shows a clear divide between volume-driven brands and those dominating the premium and revenue segments. Vivo continues to lead in units shipped, driven by its wide offline reach and accessible pricing. Samsung remains consistent with a balanced presence across segments, while OPPO and realme maintain steady mid-range momentum.

Apple, though outside the top 5 in shipment volume, has become the clear revenue leader, showing how a smaller share of high-priced devices can reshape market dynamics. Xiaomi, once dominant, is now facing pressure from both ends, premium users moving upward, and budget buyers shifting toward brands with better support or newer features.

As average phone prices rise and consumers prioritize long-term value, brands focused on software stability, local production, and upgrade-ready hardware are better positioned for the second half of the year.

Data/News Sources

- Canalys. (2025). India smartphone market Q1 2025 shipment data.

- Counterpoint Research. (2025). India smartphone shipments decline 7% in Q1 2025, premium segment drives highest-ever ASP.

- India Today Tech. (2025). Apple leads Indian smartphone market in value with 26% share.

- The Economic Times. (2025). iPhone’s 28% revenue jump in Q1 helps Apple beat Samsung in India.

- Financial Times. (2025). Apple’s quiet pivot to India.

- Reuters. (2025). India cuts import tax on smartphones in boost for Apple.